Mid-Tenn Homes

-- March 11, 2020-March 17, 2020

—

3A

May 20, 2011

Home Warranty Basics

Buying a home is arguably one of the largest

purchases a person will make. It can also be one of

the most stressful. Individuals take quite a financial

leap when buying a home. Even after careful

consideration of funds and budgeting, it’s easy to

become overextended. A home warranty can take

some of the bite out of unexpected expenses.

Although home buyers are urged to hire an inspector

and check a property and structure from top to bottom

before signing on the dotted line, a home inspector

cannot foresee everything that may crop up after a

person moves into a home.

“When my home inspector reviewed the property he

found only minor things that needed attention,” says

a local resident. “After I moved in, we shortly learned

that the crawl space had flooding issues that would

require a lot of money to fix properly.”

Bi -Monthly Home Guide

www.mid- tennhomes.com

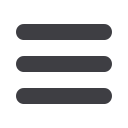

TO VIEW

ENHANCED FEATURES

VISIT ONE OF OURWEBSITES:

www.tullahomanews.com www.heraldchronicle.com www.manchestertimes.com www.themoorecountynews.comMID-TENN HOMES IS PUBLISHED TWICE A MONTH BY LAKEWAY PUBLISHERS, INC.

FOR ADVERTISING PLEASE CALL

1-888-836-6237

NEW HOME

3 Bedroom, 2 Bath

$89,000

Call 000-0000

Sign Up Now!!

Receive new listing information sent

directly to your phone along with the

agent’s contact information.

Looking to buy a new home?

Want to know about new listings as

soon as they go on the market?

Text the word HOMES to 74574

FEATURED

HOMES

CLICK HERE

Video Tours

WATCH NOW

NEW

LISTINGS

Enter Here

Home News Sports Videos

Classifieds Business Lifestyles Entertainment

Links

Shopping Subscribe

Classified Ads

Jobs

Local Real Estate

Featured Homes

MidTenn Auto

Public Notices

TN Public Notices

Search Articles

GO

Text Alerts Obits Your News

JUST CLICK HERE

ONLINE DELIVERY

THE ENTIRE PAPER

EXACTLY AS IN PRINT!

CLICK

HERE!

LOCAL NEWS

VIDEO

FOR NEW LISTINGS AND

FEATURED VIDEO TOURS AND SLIDESHOWS

TOLL FREE

March 11 2020

March 17, 2020